News

1. PEM hydrogen -making technology

2. PEM electrolytic groove market main players:

Enterprise: Changchun Green Mobile Customer: Guo Hydrogen Technology

Enterprise: CNP Pairui Customer: China Shipbuilding Group

Enterprise: Condom Customer: Sinopec

01. Technology Introduction

1. Introduction to PEM Technology

PEM electrolytic hydrogen, that is, hydrogenation of hydrogenation of protons, refers to the hydrogen making process of using proton exchange membrane as solid electrolytes and using pure water as raw materials for electrolyte hydrogen. The electrolytic groove is the core unit of hydrogen -making equipment. It is the main equipment for hydrolysis of hydrogen and oxygen. The electrolyte is charged in the groove. Under the action of DC power, the water will be decomposed and the hydrogen is generated on the cathode surface, and oxygen is generated on the anode surface.

The main places of hydrogenation of hydrogenation are electrolytic grooves, and electrolytes electrolyte water into hydrogen and oxygen under the action of DC power. Each electrolytic chamber of the electrolyte is divided into small and cathode small chambers. The cathode chamber produces hydrogen, and the anode room produces oxygen.

At present, the mainstream performance requirements of the market for electrolytic grooves are high hydrogen purity, low energy consumption, simple structure, convenient manufacturing and maintenance, long service life, and high use of materials. The main components and materials of the electrolyte include electrodes, diaphragms, and electrolytes. The electrodes are mainly composed of metal materials, accounting for about 57%of the cost of electrolytic grooves.

1.1 Technology comparison

The mainstream electrolytic hydrogen technology includes the four types: alkaline hydrolysis (ALK), proton switching membrane electrolyte (PEM), high -temperature solid oxide electrolyte (SOEC), and solid polymer anion exchange membrane electrolyte (AEM).

In our country, ALK hydrolysis technology has been commercialized, and the industry chain overall is relatively mature. PEM technology is currently in the early stage of commercialization. It benefits from local policy planning. In the future, the market size and industrial chain are expected to be further strengthened. SOEC and AEM technology currently Most of them are in the stage of R & D and demonstration, and only a small amount of product pilot commercialization.

Comparison of electrolytic hydrogen technology routes

2. Structure

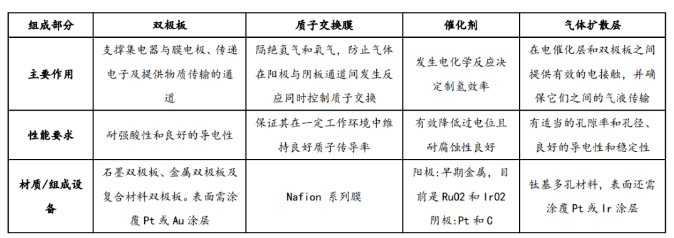

The main components of PEM hydrolytic grooves are proton exchange membranes, catalyst layers, gas diffusion layers, bipolar boards from the inside to outside. At the home of the transmission and electrochemical reactions, the characteristics and structure of the membrane electrode directly affect the performance and life of the PEM electrolytic groove.

The main component of the electrolytic slot

Data source: Journal of Huazhong University of Science and Technology

Precious metals such as platinum, titanium, and tadpoles have become the main bottleneck of PEM electrolytic grooves to expand production. It is a future development trend that reduce precious metal usage or development alternative materials. The cost of electrolyte hydrogenation depends mainly on the cost of electricity costs, electrolytic grooves investment costs and operating loads. Among them, electrical costs have the highest effect on the sensitivity of electrolyte hydrogen, accounting for 60%to 70%. With the decline in power costs, the proportion of equipment investment costs gradually increases. As the core of the entire system, the cost accounts for 45%of the system cost. Among them, bipolar boards account for more than 50%of the cost of electricity piles, and the cost of membrane electrode accounts for about 1/4, of which precious metals account for about 10%of the system cost. In the future, the expansion of PEM electrolytic grooves may not only depend on the high cost of precious metals, but its supply availability. Therefore, it is necessary to minimize the amount of precious metals or develop alternative materials.

02. Market size and main players

1. Market scale

At present, in my country's hydrogen electrolyte market, alkaline electrolytic grooves account for about 90%, PEM electrolytes account for about 10%, AEM and SOEC are still in the laboratory stage, and the degree of commercialization is low.

2022-2025 Global electrolytic tank market scale calculation

Data source: Guotai Junan Securities

At present, the market proportion of European alkaline electrolytes and PEM electrolytic slots is basically flat. In the future, the PEM share of the Chinese electrolyte market will gradually increase. The reasons are:

1) The alkaline electrolytes in China are basically the same as the start time abroad. It has been developed for 20 years. The current technical routes are relatively stable, and the threshold for industry people is not high. The improvement of sex and security, the cost of reducing the cost of products and the performance space of the product are not much improved. For PEM, for the domestic technology in the past two or three years, the research capabilities and product capabilities are relatively low. Everyone is still in its infancy.

2) European alkaline electrolytic grooves are not earlier and better than domestic development. His cost reduction is not as harmonious in China. At the same time, European countries will be more inclined to use in energy policy. PEM route, PEM's start -stop speed is fast. Due to the support of the policy, with years of PEM research and development, the cost of PEM products has dropped, and the cost of the alkaline electrolytic groove is not large. Competitiveness.

3) On the whole, compared with Europe, the PEM technology route has a technical gap of about 3 years. According to market laws, under the development of domestic PEM products and the development of landscape energy storage projects, the market share of PEM products will gradually increase in the future. Foresign things.

2. Main player

According to GGII data, the shipments of PPEM electrolytic hydrogen -made equipment in 2023 are expected to reach 0.08GW, which will increase to 19GW by 2030, with an annual compound growth rate of 124%. With the increase of PEM electrolytic tank shipments, and the expansion of market application scale brought about by technological improvement, process optimization, and cost reduction, it is expected that the market size of the PEM electrolyte film electrode market will exceed 700 million yuan in 2025, which will exceed 700 million yuan. 11 billion yuan.

At present, there are more than ten companies that can provide PEM hydrogen -making electrode products. Most products are still in the laboratory stage. The overall market trend is as follows:

1) Performance and costs need to continue to be developed and improved. At present, my country's PEM products are not mature. The cost is maintained at 3-5 times that of alkaline electrolytic grooves, and core indicators such as current density and life span have not yet reached the level. In the future, companies with better performance, lower cost, and stronger production capacity will become winners of market competition.

2) Channel and customer capabilities are the key to competition. The hydrogen -making industry is extremely dependent on the upstream and downstream of the industrial chain. The mature and mass -produced enterprises basically have equity or business connection with domestic landscape storage enterprises. Independent start -up companies are constantly cooperating with downstream to strive for orders.

PEM membrane electrode & electrolytic tank market main players